Buying art is rewarding for our soul but often it is also a good financial investment. Art acquisitions can or should be based not only on aesthetic, artistic and emotional values, but also on the potential of appreciation as an investment.

Historically art investment has offered good protection against high inflation and uncertainty or volatility on the financial markets. In the art market demand comes mainly from collectors, from financial investors who invest in art purely for speculation, from public and corporate collections and from museums or other cultural institutions. Generally the collectors acquire art as store of value for the long term, thus holding into their investments in period of uncertainty in the financial markets. In a similar way investors looking for a speculative return are attracted by the art market when the more traditional financial investments are characterized by high unpredictability. Given the intrinsic scarcity of the works of art, when both of these classes of investors are buying or holding into their art collections, the values remain high or increase.

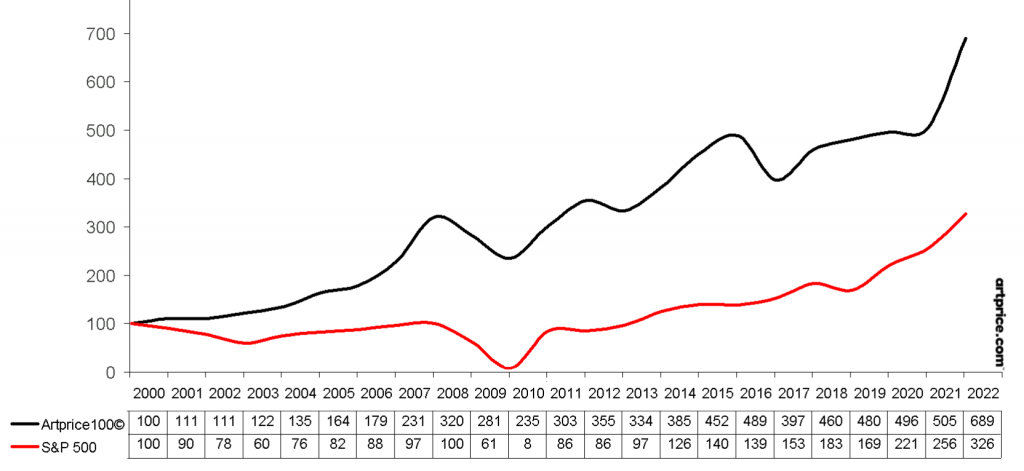

Art tends to increase in value over time. According to data collected by Artprice.com, the investment in art in the past 20 years have always consistently outperformed the investments in the financial markets. The graph comparing their Artprice100 index and the S&P500 here is impressive.

The last months of 2021 and 2022 have globally seen rising inflation rates. The art market in this same period has dramatically grown both in cumulated value and in the prices of single artworks. The first quarter of 2022 has seen records sales at auctions, with more than 200 artworks sold for more than 1 million USD. The most interesting for my taste being the1961 Magritte painting “L´Empire des Lumieres” sold at Sotheby´s London for more than 59 million GBP, three times the previous record for this master of surrealism. In May Andy Warhol´s 1964 “Shot Sage Blue Marylin”, sold for 168 million USD, reached the highest price in history for a XX century artwork. These are not isolated results, in the New York spring sales Sotheby´s, Christie´s and Phillips realized a cumulated turnover close to the records of 2018 and 2015, at over 2,84 billion USD.

Image from Sotheby´s catalogue

It is true that there are risks and downsides for the investment in works of art. Compared to the financial markets the art investment is generally less liquid, the monetization might require longer time and higher intermediary fees should be expected. When considering an investment in art it is quite important to understand the correct artist and artwork to invest in, considering the desired holding time before monetization, the risks that you are willing to take and the desired returns.

Generally speaking contemporary living artists might give better returns, but expose the investor to higher risks. A young, unknown artist might be discovered as a great innovator and a leading figure of a new movement thus with a huge potential of increase in the values of his production. However there is always the risk that they won´t be appreciated by critics, art galleries and institution and they might not realize the desired growth. On the other hand the famous and established artists of last century will not see extreme sudden growth in value as the artistic and financial value of their production has already been defined and priced by the market. Those artworks should be considered as sound store of wealth, which will steadily increase over time given the scarcity of their works but without huge speculative waves and the related risks.

The artworks we manage at MassimoMartina.art are definitely in this last category. If you want to know more, feel free to ask, we would be happy to share our thoughts with anyone interested.

Lastly, when you invest in art remember to always acquire something that you like or that is meaningful to you. While you´ll hold on your investment you will enjoy its beauty, you will share your emotions with your dearest and you will nourish your soul. The highest risk is that when the time to sell will come, you´ll prefer to keep your collection and enjoy it for longer.

I am new! Hi all!

Thanks for your blog, nice to read. Do not stop.

I have to thank you for the efforts youve put in writing this blog. Im hoping to check out the same high-grade blog posts by you later on as well. In fact, your creative writing abilities has encouraged me to get my own website now 😉

Thank you for writing this post. I like the subject too.

May I request more information on the subject? All of your articles are extremely useful to me. Thank you!

Thank you for writing this post. I like the subject too.

I love what you guys tend to be up too. This type of clever work and coverage! Keep up the superb works guys I’ve incorporated you guys to blogroll.

I enjoyed reading your piece and it provided me with a lot of value.

I’m not sure why but this blog is loading extremely slow for me. Is anyone else having this problem or is it a issue on my end? I’ll check back later and see if the problem still exists.

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is important and all. However think of if you added some great graphics or video clips to give your posts more, “pop”! Your content is excellent but with images and clips, this site could certainly be one of the greatest in its field. Amazing blog!

I simply had to appreciate you all over again. I’m not certain the things that I could possibly have taken care of in the absence of the actual strategies provided by you about my industry. Entirely was an absolute frustrating condition in my position, but looking at the skilled manner you dealt with the issue made me to cry with fulfillment. I’m just grateful for your service and even trust you really know what a great job you are always doing educating others through the use of your web page. Probably you have never come across any of us.

I am always browsing online for tips that can aid me. Thanks!

I will immediately grab your rss feed as I can’t in finding your e-mail subscription link or e-newsletter service. Do you have any? Please let me know in order that I may just subscribe. Thanks.